Do you love yourself and your Family? Kaiser Does!

Protect your future if you live too long and protect your family in case you die too soon. Kaiser can answer our 3 major financial needs. Watch the video presentation to know more about it. Please provide your details below if you are ready to discuss.

Kaiser International Health Group Inc.

We are duly accredited with the Department of Health (DOH). Our Company is likewise, registered with the Securities and Exchange Commission (SEC) on June 08, 2004 as a Health Care Provider with an Authorized Capital Stock of Php 160M.

Kaiser International Health Group Inc. is far more than an HMO. While most HMOs cater to both group and individual accounts, Kaiser's product is geared to address the long-term health care needs of individuals especially after their employment and retirement years.

Our Mission & Vision

A lot of us have to work day and night just to make ends meet. These are the signs of the times. We are living in an insecure world. Almost every country's rate of unemployment has been at its highest these past couple of years. There is no "safe" place anymore. Our peso has devalued at a rate so fast in the last 10 years. That's why we have to be wiser about our money, about our investments, the security of our health, our family, our old age. We cannot expect the normal health services or retirement funds to be enough. We have to take care of ourselves, take things into our own hands! We have got to insure ourselves for the future. With Kaiser, we can do all that! That's the beauty of it!

With that in mind, we have come to state Kaiser's vision and mission:

"We shall aim to be the industry leader in providing maximum, long-term and short-term health care benefits to all our members."

"We help build a secure future and wise financial foundation in coping with inevitable medical expenses each of us would one day face especially after employment and during retirement years."

BAKIT NGA BA MAGANDANG KUMUHA NG KAISER 3-IN-1?

lONG-TERM HEALTHCARE

Ang mga traditional HMO (Health Maintenance Organization) ay short-term lang. Magbabayad ka ng annual premium for a certain healthcare coverage. Magamit mo ito or hindi ay babayaran mo pa rin every year kung gusto mong ipagpatuloy ang healthcare coverage.

Sa Kaiser, puwedeng maging short-term at long-term. Kung nag-avail ka nito at biglang nagkasakit magagamit mo ang healthcare benefits. Paano naman kung hindi magamit? Okay lang! Dahil si Kaiser ay long-term healthcare din kung saan ang hinuhulog mo ay hindi masasayang at magagamit mo pa rin in future needs.

LIFE INSURANCE

Sa traditional HMO (Health Maintenance Organization) kapag sinabing healthcare ay Pure Healthcare lang.

Sa Kaiser, hindi lang siya basta healthcare. May Life Insurance coverage din na kung saan ay protected ang pamilya.

Halimbawang may mangyari sa policy holder ay makakatanggap ang beneficiaries nito ng instant money mula sa Insurance Company.

Bukod pa doon ay may Waiver of Installment due to Death, Waiver of Installment due to Total and Permanent Disability at Transfer of Kaiser Policy to the Principal Beneficiary.

SAVINGS & INVESTMENTS

Bukod sa healthcare at life protection, ang kaiser ay may investment din.

Kung healthy ka at hindi mo nagagamit ang healthcare coverage bibigyan ka pa ng BONUS ni kaiser sa Maturity ng iyong 3-in-1 Saving Plan.

Makukuha mo ang lump sum sa 20th year ng iyong plan. May option ka rin na i-retain lang ito upang lumago pa ang pera mo.

Imagine? Nag-save ka lang sa loob ng 7 years may makukuha kang malaking halaga sa Maturity Period ng Saving Plan mo. Para ka ring may pension na pwede mong kuhanin buwan-buwan dahil good as cash itong investment mo.

The Three (3) Important Phases of a Kaiser Plan

1st PERIOD: Accumulation Period or The Paying Period (1st to 7th year)

2nd PERIOD: Extended Period or The Growth Period (8th to 20th year)

3rd Period: The Maturity Year/ Long-Term Care Period (21st Year onwards)

1st PERIOD: Accumulation Period or The Paying Period (First 7 Years)

For the first 7 years you will be paying for the plan. During this time, it works like a typical HMO wherein you have an annual benefit usable for hospitalization expenses. These are also a couple of benefits, like:

• Benefit of free Annual Physical Examination after one year of payment.

- Physical Examination, Chest X-Ray, Routine Fecalysis, Routine Urinalysis, Complete Blood Count

- ECG for Members above 35 and Pap Smear for Female Members above 35 years old or as required.

• Benefit of free Dental Check-up and the following;

- Unlimited Dental Check Ups

- Unlimited Simple tooth extraction

- Once A year Free Dental Prophylaxis

- Recementation of jacket, crowns, inlays, on lays and

- Minor adjustment of Dentures

• Term life Insurance (up to age 75) with accidental death and dismemberment riders.

• In-Patient benefits in accredited hospitals except for pre-existing conditions and dreaded diseases, up to plan annual benefit limit.

• Waiver of installment/ Premium due to death/ total and permanent disability.

2nd PERIOD: Extended Period or The Growth Period (next 13 years)

During this phase, you have completed all the payments and all you have to do is wait and let the plan reach its 20th year (maturity) at this point your will have a starting cash value that you can also use for your medical expenses. The money is invested in government and corporate bonds, which are expected to yield 7-10% compound per year.

Comparison to other providers: during this period, the Kaiser plan is still there for your short-term healthcare needs. The money is still growing at this stage and it is at this period when the Kaiser plan starts to step-up and be more competitive with the other healthcare providers.

• Term life Insurance (up to age 75) with accidental death and dismemberment riders.

• Accumulation of unused Health Benefits at 7-10%

• In-Patient and Out-Patient Hospitalization Benefits subject to remaining member accumulated fund.

• Accumulation of unused Health Bonus at 3-13%

3rd Period: The Maturity Year/ Long-Term Care Period (20th Year onwards)

At the plan’s maturity at 20th year, several bonuses will be awarded like the Long-term care benefit and bonus, plus about 85% of the premiums will be returned to you if you didn’t use the plan during the earlier stages, here, the cash value of your investment would also be good as cash- meaning you can use it for anything not just hospitalization and medical expenses.

Comparison to other providers: at this Period, Kaiser stands out because most healthcare providers are already too expensive by the time you reach your 40s or even 60s. On the other hand, your money with Kaiser has already accumulated and depending on the plan you chose, your Total Health Benefits would be upwards of P500,000 all the way to several millions.

ULTIMATE KAISER HEALTH BUILDER

Pre-Computed Table

Meron kang benefits ng Long term Healthcare na pwede mong magamit khit beyond 100 years old ka na. No traditional HMO will cover you kapag retired ka na, only Kaiser Longterm Healthcare.

Once nag-start ka ng Kaiser, automatic insured ka na ng Term Insurance nito and just in case mawala ang Policy Holder makukuha ng beneficiaries ang Instant Money from the Insurance, Waived na din ang Kaiser Plan, ibig sabihin wala ng iintindihin ang Family. Plus magagamit pa nila yung Health Benefits at makukuha pa nila ang money sa Maturity.

Sa 20th year or sa Maturity makukuha na good as cash ang Investment. Depende sa kukunin na Plan kung magkano ang Maturity nito and option mong kunin ang Fund or Hindi. Kapag ni-retain mo lang ang Funds after the Maturity kumikita pa ito ng 7-10% per year.

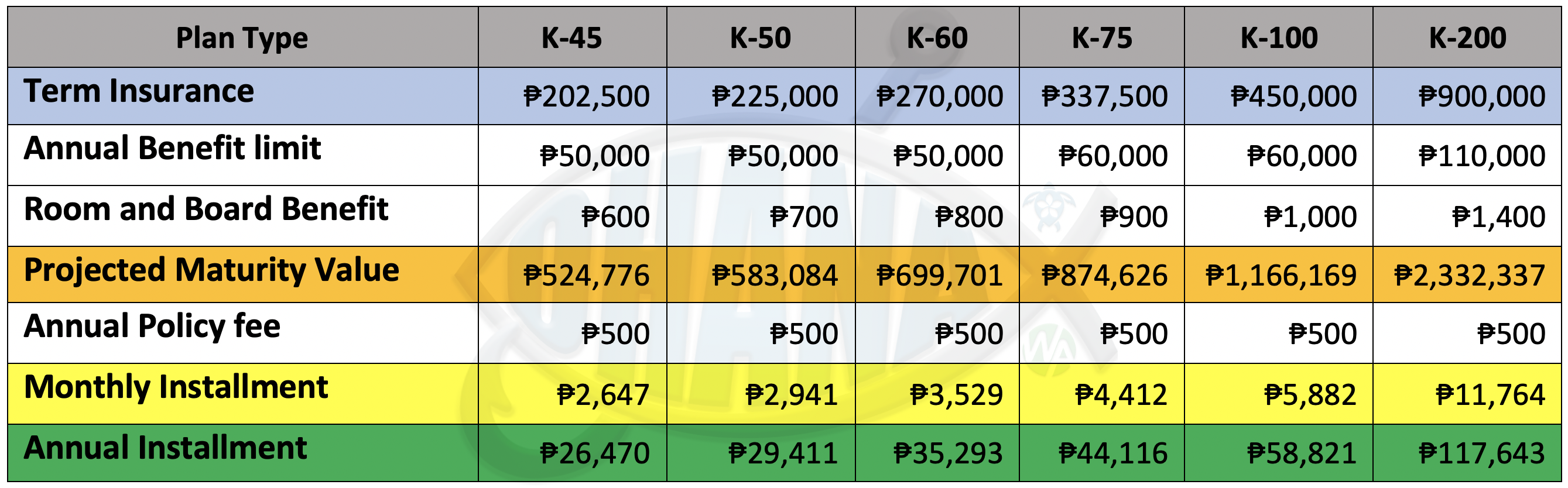

For ages 10-40 years old

- Minimum is 2,647 per month

- FREE Annual Physical Exam

- FREE Dental (Linis, Bunot & Pasta)

- Hospitalization Benefits of 50,000 per year

- Life Protection of 202,500 - 405,000

- And Investment of 524,776 which is good as cash sa Maturity (at the 20th year)

For ages 41-50 years old

- Minimum is 3,529 per month

- FREE Annual Physical Exam

- FREE Dental (Linis, Bunot & Pasta)

- Hospitalization Benefits of 50,000 per year

- Life Protection of 270,000 - 540,000

- And Investment of 699,701 which is good as cash sa Maturity (at the 20th year)

For ages 51-60 years old

- Minimum is 4,412 per month

- FREE Annual Physical Exam

- FREE Dental (Linis, Bunot & Pasta)

- Hospitalization Benefits of 60,000 per year

- Life Protection of 337,500 - 675,000

- And Investment of 874,626 which is good as cash sa Maturity (at the 20th year)

HOW TO START YOUR KAISER SAVINGS PLAN

SINO ANG MGA ELIGIBLE KUMUHA NG

KAISER 3-IN-1?

- 10 years old to 60 years old only.

- Lahat ng Pilipino, even OFWs.

- Even the minimum wage earner, dahil affordable ito.

- Puwede rin sa mga high risk jobs like Police, Firefighters, etc.

- At Kahit pa may mga existing illness na, siguraduhin lang na i-declare ito sa kaiser application form. This is subject for approval. (case to case basis)

OPTION 1 (OFFLINE)

Pwede kang magpunta sa aming Financial Center upang mag-fill out ng Kaiser Forms.

Click the button below for instructions.

OPTION 2 (Online)

Pwede ka mag-enroll ng Kaiser Saving Plan mo through Online Kaiser Application.

Click the button below for instructions.

OPTION 3 (EMAIL)

Pwede rin iprint ang Kaiser Forms at ifill out ang mga details at isend sa email

Click the button below for instructions.

Get in touch! We're here for you...

Other ways to get in touch:

You can always contact me anytime on my contact details listed below;

ADDRESS

Port Saeed, Deira

Dubai

United Arab Emirates

PHONE

+971 58.148.5743 (Whatsapp/Viber)

EMAIL

[joylyna12@gmail.com]